Professionally-minded social network LinkedIn once again beat Wall Street analysts’ expectations this afternoon when it announced the financial results for the third quarter of 2012.

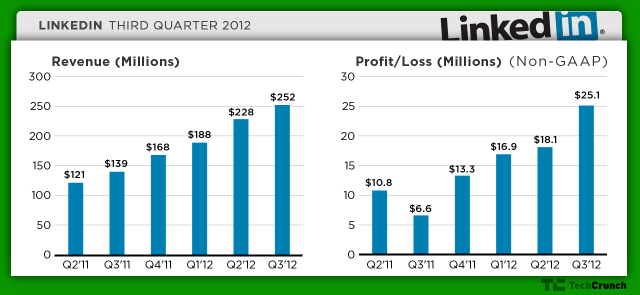

LinkedIn announced that it made $252 million in revenue during the third quarter, up 10 percent sequentially from its Q2 revenue of $228.2 million and up 81 percent year-over-year from its Q3 2011 revenues of $140 million.

At the bottom line, LinkedIn posted GAAP earnings per share (EPS) of two cents per share, down from its second quarter GAAP earnings of 3 cents per share and its net loss of 2 cents per share in Q3 2011. On a non-GAAP basis, which is where analysts generally focus when evaluating LinkedIn’s performance, the company’s EPS was 22 cents, up from Q2’s non-GAAP EPS of 16 cents and Q3 2011’s non-GAAP EPS of 6 cents per share.

This means that LinkedIn easily surpassed Wall Street’s expectations at both the top and bottom lines. According to FactSet, analysts projected LinkedIn to post $244.61 in revenue and non-GAAP earnings per share of 11 cents for Q3 2012.

Here’s a snazzy graphic from TechCrunch’s Bryce Durbin to help see just how this quarter compares to LinkedIn’s prior ones:

In a press release, LinkedIn’s CEO Jeff Weiner had this to say about the quarter:

“LinkedIn had a strong third quarter with all of our key operating and financial metrics showing solid growth. The last few months mark the most significant period of product development in the company’s history. This accelerated pace of innovation is fundamental to our goal of driving greater engagement on the LinkedIn platform.”

Looking ahead, LinkedIn also gave new guidance on how it expects to perform in the upcoming quarter. The company now expects its Q4 revenue to be between $270 million to $275 million, with adjusted EBITDA ranging between $58 million and $60 million. It’s also boosted its full-year guidance: LinkedIn says its 2012 revenue is now expected to be between $939 million to $944 million — that’s significantly higher than LinkedIn’s previous projection of $915 million to $925 million. Its full-year EBITDA is now projected to be between $202 million to $204 million, up from the prior range of $185 million to $190 million.

LinkedIn has been in the stock market’s good graces ever since its May 2011 initial public offering. While other new web stocks such as Facebook and Zynga have foundered a bit since their IPOs, LinkedIn’s share price has performed well — its stock closed today at $106.85, more than double its $45 IPO price.

Today’s results have continued to impress those public market investors, it looks like: In the first half hour after LinkedIn announced its Q3 earnings, the company’s stock price was nearly six percent in after-hours trading.

Updating.