Q3 is the first full quarter that Facebook has been offering businesses the ability to buys ads across all of its mobile user base, and according to the latest quarterly report from ad agency TBG Digital (embedded below), it’s a winning strategy so far. The reason? Mobile ads continue to drive more engagement than any other ad format.

In the U.S., mobile ads that run in the news feed had click-through rates — seen as a key metric for ad engagement — 23 times higher than Facebook’s Facebook’s Desktop News Feed and Right Hand Side ad formats alone (that works out to 1.290% for mobile, versus 0.057% for the desktop options).

That’s helped to push average click-through-rates across the whole Facebook ad network, as measured by TBG, by some 81% in Q3 (that’s compared to only 11% last quarter), with the U.S. winning biggest of all with a 99% increase.

The report comes out one day ahead of Facebook reporting its Q3 earnings, and could give some focus to the numbers that Facebook releases tomorrow. TBG’s numbers are based on 520 billion impressions, in 190 countries for 282 of its biggest clients, and it’s been analyzing the data quarterly since Q1 2011 in conjunction with the University of Cambridge in England. For the moment, advertising is Facebook’s primary revenue generating service — although it has been making more moves into commerce, both selling physical items itself (Facebook Gifts) as well as facilitating purchases for others.

Back to TBG’s numbers: some might argue that that positive numbers for mobile may have to do with a couple of other things: specifically, the novelty of the ad format — users have yet to get inured to seeing ads in their mobile news feeds to start ignoring them; and the fact that it’s easy to accidentally click on a mobile ad on a touchscreen.

But for now the numbers show that the mobile format is still on an upswing. The last quarterly report published by TBG noted that CTRs were 14 times that of desktop ads — a sign that they have been relatively successful for a couple of quarters now and continuing to improve. Equally, there is a case to be made for mobile also being used to lift performance on desktop: TBG also found that targeting desktop and mobile News Feed ads together gave an even better performance, with CTRs of 1.468%. Similarly, wider engagement rates for Page Post ads were 2%+.

What we don’t know yet is if Mobile and Desktop News Feed ads will prove to be as popular long term with advertisers in other parts of the world outside the U.S. A key issue considering much of Facebook’s growth is happening in the rest of the world.

TBG’s CEO, Simon Mansell tells me that right now U.S. brands are still showing a much stronger appetite for social advertising.

As an example, he cites a client of TBG’s that in the U.S. budgeted $1 million in Q3 on social ads (those that run in news feeds on mobile and desktop, and connect to other Facebook content).

In contrast, that exact same client spent only $5,000 in Q3 for similar campaigns in Europe. “In Europe, the preference is for ads that are direct-response focused,” he says. “Brands are more interested in formats like the ASU [advertising standard unit], which sends traffic off Facebook to those brands’ sites,” he notes.

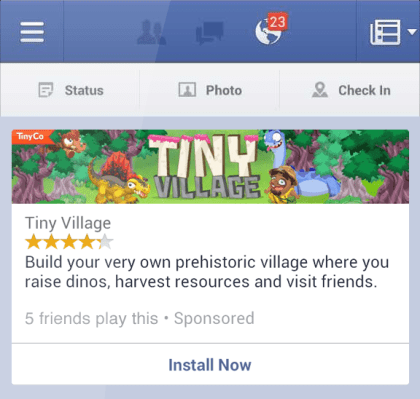

He does add that as Facebook introduces more formats to the mobile platform, this is likely to pick up. “The new ad unit to promote mobile applications could see an uptick in mobile ad buys from brands looking to promote mobile apps specifically,” he says. (An example of that is pictured here, and more on that format here.)

Perhaps because of this emphasis on less social (and more incumbent) forms of advertising on Facebook, CTRs are proving to be less impressive in the Old World than in the North America. While the U.S. saw CTRs up by 99%, and Canada saw growth of 37%, Germany was up by only 8% and the UK and France respectively actually saw drops of 4% and 25%.

Another trend worth pointing out is that while CTRs are up, Facebook may still be holding back the reins for how much advertising is coming across on our mobile screens. TBG notes that the cost-per-click on mobile currently remains a lot higher than it does on desktop. Mansell says that this is likely down to Facebook limiting inventory to make sure that users do not feel overloaded (and turned off by) too many ads on their mobile devices: so a case of supply and demand. Overall it notes that average CPCs are down to 2010 levels, and is in contrast to last quarter when CPCs shot up:

“Last quarter, we attributed the increase in CPCs to advertisers bidding more to ensure their ads were delivered,” TBG writes in the report. “This quarter the high CTRs provided by News Feed ad placements has meant that advertisers do not have to spend as much to ensure Facebook earns their target CPM per ad impression. This may have had a positive effect on CPCs. We expect to see CPCs rise as competition for inventory increases. “