Gyft, the TechCrunch Disrupt SF 2012 finalist, which lets you buy, save, redeem and share gift cards using your iPhone, has just launched Passbook integration. Because Gyft supports storing your plastic gift cards thanks to its relationships with retailers and data partners, this integration means you can now dump out all those plastic cards cluttering up your physical wallet and just use your iPhone instead.

The startup currently sells and stores cards from over 200 major retailers, including Amazon, Brookstone, Lowe’s, Toys “R” Us, Sephora and others, but cards from other retailers Gyft isn’t officially working with can be stored in the Gyft application as well.

Gyft CEO Vinny Lingham had pre-announced this news on stage during the Battlefield finals at Disrupt earlier this month, but the functionality was not complete at the time. After sending in the update to Apple last week, Lingham tells me that the promised Passbook integration was just approved last night.

For those of you unfamiliar, Gyft is a company that’s trying to bring the plastic gift card industry to mobile, as opposed to focusing on new “social gifting” experiences like some of the other gift card startups operating in this space currently do. While the Gyft app supports storing a variety of gift cards, users will also be able to check their balances on the cards Gyft has a retailer partnership with, thanks to the app’s ability to interoperate with the retailers’ backend systems.

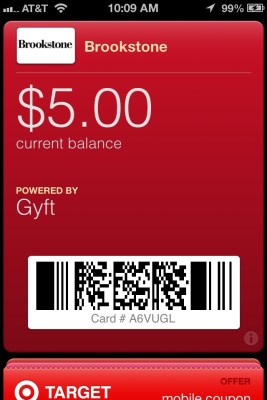

In the updated app, the Passbook integration is offered on a per card basis, which may mean a little bit of work for those of you who have a lot of cards to transfer over from your current wallet. But the end result is worth it: instead of having a generic “Gyft” card stored in the Passbook app, you’ll have what appears to be the individual store gift cards there, powered by Gyft.

Startups Adopting Passbook Offer Alternatives To “Official Apps”

It’s too soon to call Apple’s Passbook a success – there are still many kinks to work out, including employee training and education, for starters. See Darrell’s real-world Passbook test here, for example. Plus, this weekend, a Walgreens clerk asked me to “turn up the brightness” on my iPhone when my Passbook card didn’t scan. That didn’t work. She said she would have to bring up the issue with the manager, but hey, maybe she could just look me up by phone number instead? These inconveniences are acceptable at first launch as everyone is confused and learning something new, but if successful scans continue to be hit-or-miss experiences, users and stores will quickly revert to the old ways of doing things.

Despite these potential pitfalls, some startups are now viewing Passbook as a way to attract and engage users, both new and existing. Gyft is essentially bringing several more retailers to the Passbook app, even including those who have yet to adopt the feature officially.

Meanwhile, Belly, a loyalty card startup, is another one of the youngest companies on Passbook. And it’s today reporting some huge numbers thanks to the integration. The startup says it saw over 20,000 app downloads during the weekend, which has pushed the app to well over 500,000 users. It’s been the biggest four days in Belly’s history, the company told us this morning.

Another former TechCrunch Disrupt finalist, the mobile coupon sharing app SnipSnap, is also preparing to launch Passbook integration in October. Currently, the app lets users snap photos of store (not manufacturer) coupons and trade them within the app, allowing other users to save those shared coupons into their own virtual wallet of sorts.

According to SnipSnap CEO Ted Mann, the export-to-Passbook feature will support 2D barcodes, but the cool thing here is that SnipSnap will let you send individual coupons to your Passbook. That means you’ll be able to see which stores the coupons are associated with and what item they’re for, right from the front of the Passbook card itself. That’s an improvement over the current couponing experience in Target’s own app, for example, (one of the stores supported in SnipSnap), because with Target’s Passbook integration, you have to hit the small “i” button on the front of the card to see your mobile coupon details. That’s a bit cumbersome.

The interesting thing here about startups’ adoption of Passbook is that they’re able to move more quickly than the major brands, offering what some would even argue is a better experience than the “official” route. (At least, I would.) That could bode well for Passbook adoption – the numbers we’ve been seeing indicate user curiosity and interest in the feature, at least. And if a retailer hasn’t yet launched a Passbook experience for their users, these startups could benefit from users’ desire for a mobile wallet/couponing option. But all this hinges on whether or not whether or not cashiers out in the real world have been trained, and have equipment and systems that actually work. And in Passbook’s early days, that hasn’t always been the case.