Ozon, the Russian e-commerce giant that started as an online and electronics bookseller but has since branched out into fashion and logistics services for other companies, is often called “Russia’s Amazon” for its size and scope. But in an interview today, CEO Maelle Gavet says the comparison only goes so far, for now. She tells TechCrunch that despite some tests, there are no current plans on the agenda for Ozon to develop its own e-readers, tablets or other devices. Cloud services, however, are another story.

The comments were made on the same day that Ozon announced six-month results that show continued growth: they are up 78% on last year to $232 million (91% up in rouble terms to R7.1bn); these are pro-forma figures that are adjusted to include its acquisition of shoe/accessory site Sapato in February. It’s relatively little compared to Amazon, which posted revenues of $12.8 billion for last quarter. But Ozon is growing faster at the moment, and as Gavet points out, Russia is still a largely untapped opportunity: less than 20% of Russia’s population shops online at the moment.

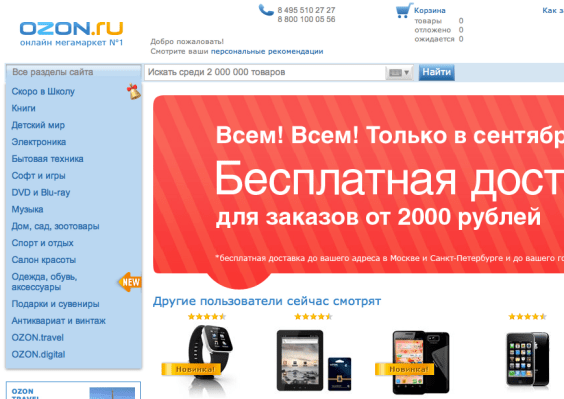

Other highlights from those earnings: Ozon now has 11.1 million registered users; 17.3 million unique visitors to its sites. That’s including the user base of fashion commerce site Sapato.ru, bought at the beginning of this year and now “seamlessly” blended in with Ozon’s operations, according to Gavet. Products in Ozon’s range currently stand at 2.2 million with plans for that to go up to 9 million soon, with the addition of a second warehouse. Gavet tells us that revenue growth comes from strong performance across all divisions — Ozon.ru itself, Sapato, O-Courier and Ozon.travel — an online bookings service.

Despite the moves into fashion, travel and logistics, for now books and electronics are still the mainstay of Ozon. (On Ozon.ru, the breakdown is books (34.3%), electronics (33.7%), with DVD, software, games and music, parent/kids products, sports and beauty, antiques, and other things making up the rest.) Will you follow in Amazon’s footsteps and offer e-readers and tablets?

We did a test a year ago but we felt that the market was not ready for it. The Russian market already has a lot of different devices [including this latest effort for a secure Russian OS-based tablet] so we focus on other things. Also the digital market is not the same here as in the U.S. It still has a lot of piracy, a lot of publishers don’t even have the digital rights. So it’s still a market in the making. It will remain very small for now.

But we’re constantly looking at all the different options, and keep focusing on the content we offer being available across all interfaces (through apps for iOS, Android and Samsung’s bada), because we believe there will be enough devices on the market to use that.

It could change in 6-12 months’ time. We’re trying to be present on every single platform, but whether that draws us into making our own device, I’m not so sure.

What about cloud services and something like the equivalent of Amazon Web Services? Any plans there?

It’s too early to answer but it’s a very good question. We’re looking at a lot of different options for something in the next 12-18 months. No more on that for now: in France there is a saying: “don’t sell the skin of the bear before having killed it.” [Ne pas vendre la peau de l’ours avant de l’avoir tué.]

What about logistics? That’s something that we are seeing from other Russian e-commerce players like KupiVIP and Lamoda, who have developed their own distribution servicers partly out of the lack of existing infrastructure and are now using it for third parties. I see you now have 2,100 pick-up points in Russia and Kazakhstan.

Because we have invested so heavily into infrastructure and logistics we are now offering those services to third parties. We already have 70 small merchants working on the platform but we are woking to grow that fulfilment operation. We are different from KupiVIP in that we work with a lot of non-fashion brands, too. This part of our business is growing well; it’s a two-digit percentage number way above 10%, and we expect soon for the majority of the stock going through our system to be from third parties.

Plans for an IPO?

It’s definitely not on the agenda at the moment. It’s too early for us. We’re very much focused on growing the company, being able to achieve high growth rates is our priority. We raised $100 million last year and have a lot to do to build ourselves up as an international player.

What is the international strategy?

Yes we are looking at adjacent republics like other Russian e-commerce companies, but also there is such huge potential here in Russia: today less than 20% of Russia shops online. Growing internationally right now would mean less focus on Russia, so that is not necessarily the best option.

What about acquisitions? Any more Sapatos coming up?

Since our $1oo million fundraising last year [Ozon’s investors include Baring Vostok Private Equity, Index Ventures and ru-Net Ltd, as well as Rakuten, Intel Capital, Holtzbrinck and Cisco], our strategy has been to grow everywhere. The problem is that there are not too many targets. We haven’t found aything worth investing in. If we see the same type of company as Sapato, with the same potential, we will acquire them. But we haven’t found anything yet.