RIM has just released their fiscal Q1 2013 financials, and they’re about as bleak as the company expected. The Canadian company reported a net GAAP loss of $518 million (which breaks down to $0.99/share diluted) on revenues of $2.8 billion.

To put that in a bit of perspective, RIM reported a net loss of $0.24/share diluted (or $125 million) on $4.2 billion in revenues in Q4 2012. Meanwhile, analysts expected RIM to report a net loss of $0.03/share on revenues of $3.1 billion in the days leading up to the release.

The company also reported that despite their longstanding claims to the contrary, the first BlackBerry 10 smartphone isn’t expected to see the light of day until the first quarter of calendar 2013.

“RIM’s development teams are relentlessly focussed on ensuring the quality and reliability of the platform and I will not compromise the product by delivering it before it is ready,” said CEO Thorstein Heins.

The news comes as a huge blow to BlackBerry devotees who believed the company when they originally announced their “late 2012” launch window. As the company continues woo developers to their platform, they’re now faced with an even bigger challenge — keeping potential customers interested in a final redemptive product that will be even later to market than expected.

RIM also noted that they shipped 7.8 million BlackBerrys and roughly 260,000 BlackBerry PlayBooks. For those keeping track, the company shipped 11.1 million BlackBerrys and “over” 500,000 PlayBooks in the previous quarter.

Though their financials don’t paint a rosy picture for the company, the news doesn’t come as much surprise. The beleaguered Waterloo smartphone maker temporarily halted trading on May 29 to issue a “business update” in which they warned of an operating loss this quarter because of a particularly rough transition period.

They declined to delve into more specifics, as the company had announced earlier in the year that they would no longer provide quantitative financial guidance — perhaps not the most confidence-inspiring thing RIM has ever done. Of course, there have been plenty of other events in RIM’s recent history that fail to paint a rosy picture for their future — for example, its tough to say whether or not their recent layoffs portray a company making itself leaner and more focused, or just desperate to save money. All we can say for certain is that those layoffs will continue, as RIM has revealed that they plan to cut 5,000 jobs as part of their reorganization.

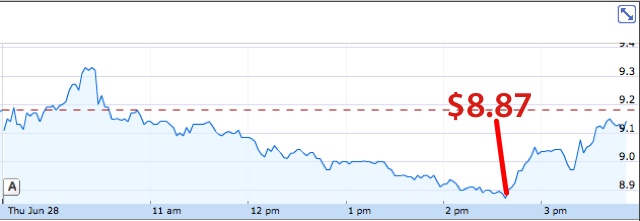

On that note, shareholder confidence in the company was seemingly shaken today as well — at one point during trading RIM’s stock price dipped to $8.87 per share. While the stock managed to recover toward the end of the day, it was still terribly close to the 52 week low of $8.83 it hit a few days ago. Even though their stock hasn’t hit a new low, this is territory that would’ve been completely unheard of for them at any other point in the past five years.

As usual, RIM will be conducting an earnings conference call at 5PM ET, and we’ll be listening in for any new developments.