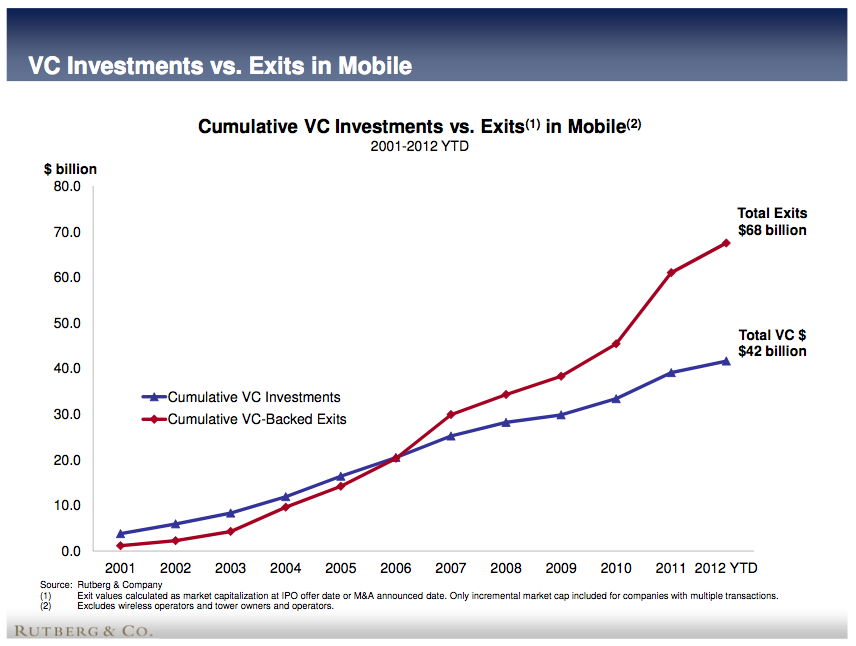

2011 was an impressive year for mobile exits: according to investment bank Rutberg & Co. it topped out as the biggest-ever for mobile IPOs and acquisitions: $15.5 billion in total transactions, 63 percent higher than previous record holder, 2007. But halfway through 2012, Rutberg believes that this year could be either just as big or bigger: in the year to date, there have been $6.5 billion in transactions, according to new research out today.

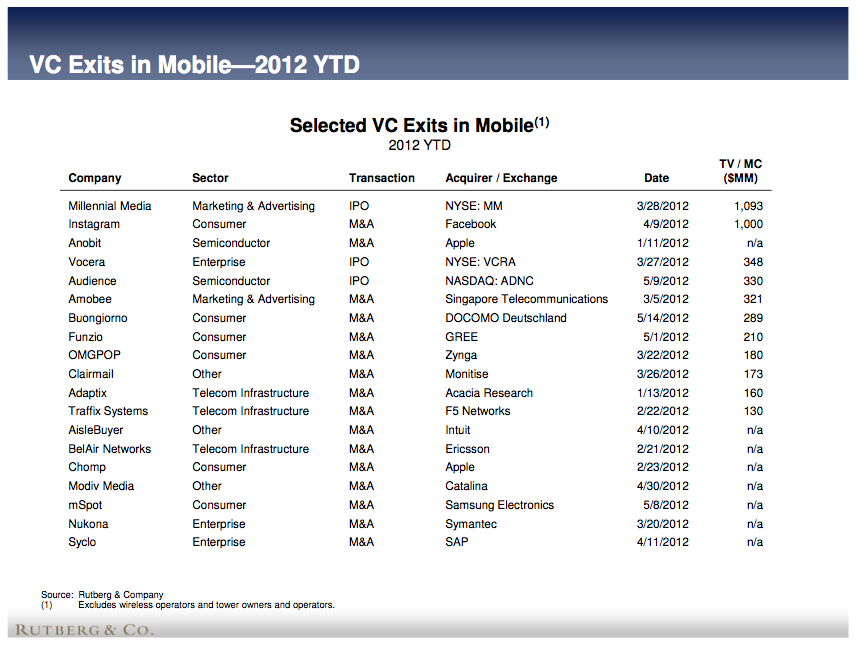

Led by the (still pending) $1-billion acquisition of Instagram by Facebook and the $1.093 billion IPO of mobile ad company Millennial Media, 2012 has rung up exits totaling nearly as much as all of 2010. 2007 saw $7.1 billion in mobile exits, with values split nearly equally between IPOs and M&A. In contrast, 2012, up to now, has been much more uneven: $4.6 billion in M&A, with $1.9 billion in IPOs.

That is a trend that Rutberg’s MD Rajeev Chand believes will continue as investors continue to ruminate on the “dark cloud” of Facebook (and, perhaps to a lesser extent, Groupon and Zynga’s debuts) in the public markets. “Facebook’s IPO will have a delay effect on all tech IPOs,” he says, including those for mobile companies.

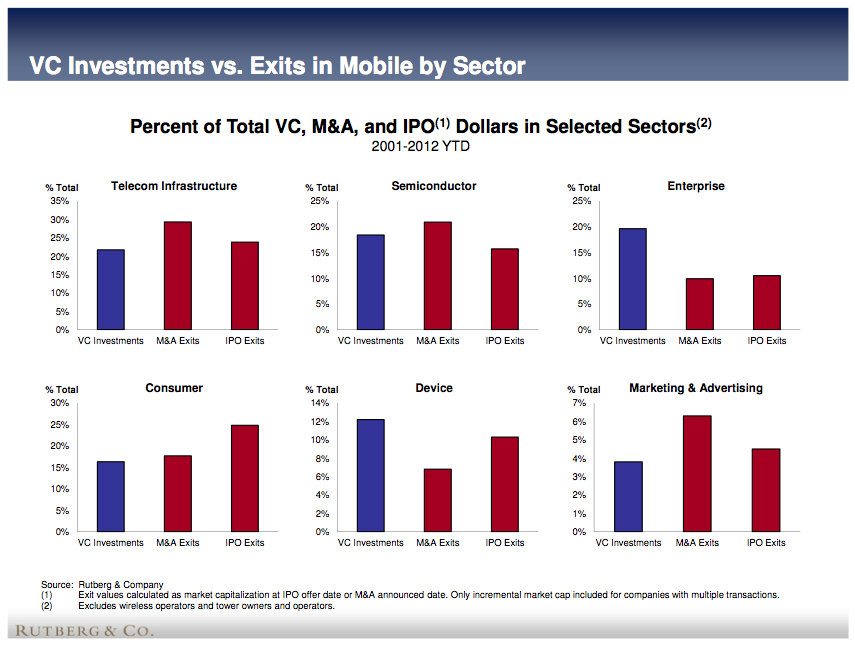

Over the last 11 years, as you can see from the graphic below, Consumer mobile services appear to have grown the most as IPO targets, although some of that may have been related to activity during the big dot-com bubble at around 2001.

The fact that Millennial Media and Instagram are the most valuable exits so far in 2012 point to another trend: the shift in value from infrastructure to other sectors like apps and services — a growth that Chand traces back to the rise of Apple’s iPhone in 2007 and the effect that it had on the whole ecosystem, spurring the development of apps and services catering to that business (such as mobile ads).

But infrastructure is still there, and ironically the two acquisitions Apple has officially confirmed in 2012 speak to continued attention to both sides of the equation: Israeli semiconductor and flash memory maker Anobit, reported to be bought for between $400 million and $500 million; and app discovery and analytics giant Chomp, reportedly for $50 million.

Among other non-infrastrcuture exits, after Millennial Media and Instagram, the next two most valuable exits were by operators acquiring to pick up new business and expertise — part of the trend Chand describes as “inorganic growth strategies” by businesses wanting to have more fingers in the mobile pie: the $321 million sale of mobile marketing and ad company Amobee to Singtel and mobile content company Buongiorno’s sale to Docomo for $289 million.

Funzio’s sale to Gree for $210 million, OMGPOP’s acquisition by Zynga for $180 million, and Clairmail’s acquisition by Monitise round out mobile content exits in the top 10.

Chand believes that mobile, along with other innovations in cloud and social media technologies, are fundamentally changing how consumers behave and businesses operate. Like others, Chand believes mobile is also gradually ceasing to be a category unto itself.

“In our view the PC Internet was a ‘dress rehearsal’ for what will come with mobile,” Chand writes. “We are ‘half a shade’ away from a time when the term mobile as an identifier will disappear.”

Even so, Rutberg has chosen to not include companies like Facebook in its mobile IPO tally, despite it having some half its 900 million+ users already accessing the site using mobile devices, and clearly focusing on the mobile platform as an engine for future growth.

“Our exits analysis focuses on private companies which are mobile first or principally mobile (revenues, users, usage),” Chand explains. “Facebook did not start as mobile first or principally mobile and is not included in our numbers.”

Ditto for one of the biggest M&A mobile plays, the acquisition of Motorola Mobility by Google for $12.5 billion, which closed in May. This, he says, is not included because Motorola is a longstanding public company, and “this chart focuses on venture-backed exits, to show the opportunity for entrepreneurs and venture investors.”

Judging from the graphic below, however, there seems to be a slight tailing off in terms of VC funding versus exits, perhaps a sign of how the space is maturing and attention is going elsewhere?

Image: 401k, Flickr