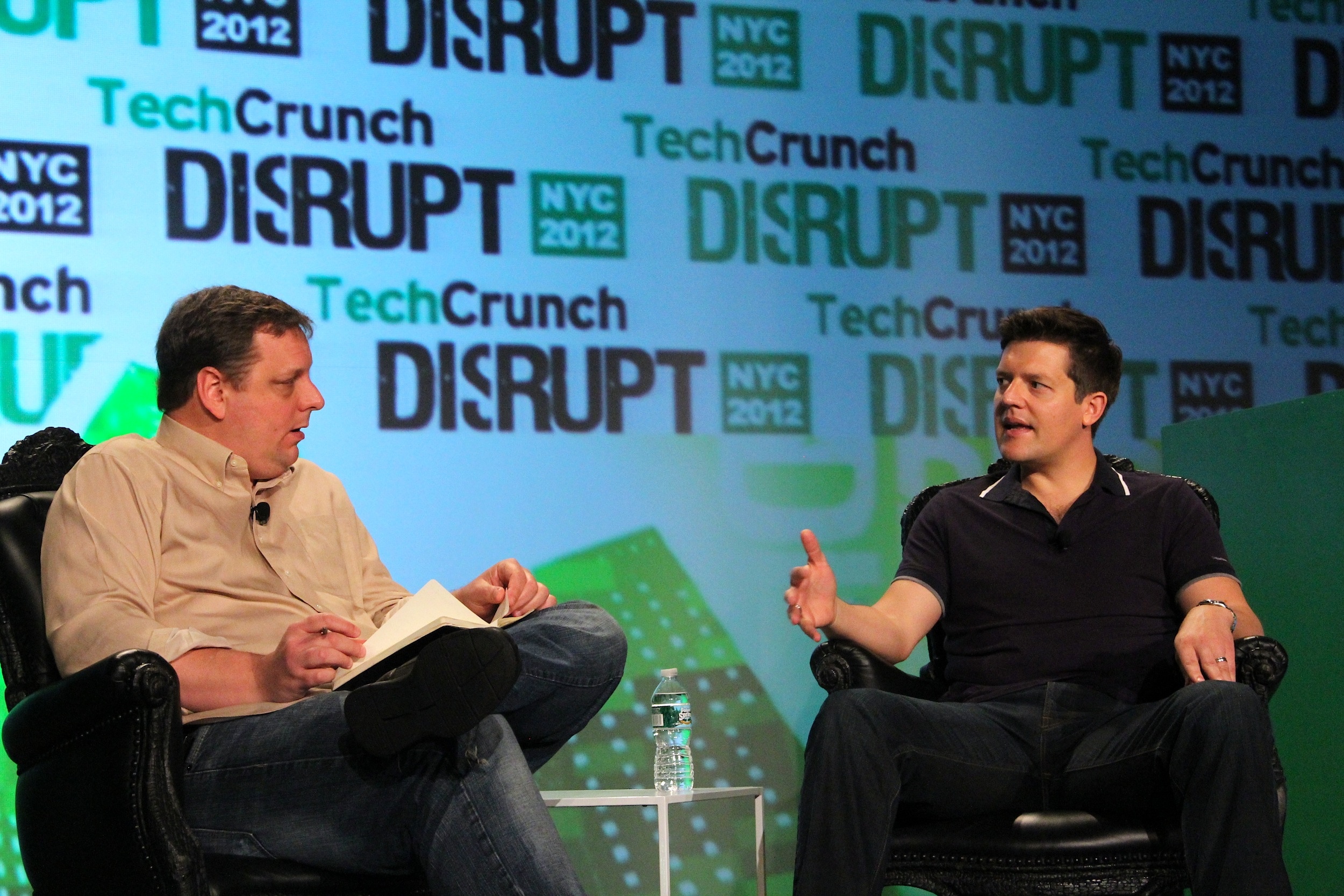

TechCrunch founder Mike Arrington sat down with Sequoia Capital partner Roelof Botha in another fireside chat at TechCrunch Disrupt NY 2012 this morning. Prior to joining Sequoia Capital in 2003, Botha served as the Chief Financial Officer of PayPal during its sale to eBay, and today considers himself a champion of consumer web plays. He also sits on the board of hot startups like Eventbrite, Square, TokBox, Tumblr, and Jawbone, to name a few. And he’s an investor in other startups like Unity Technologies, a company helping developers build 3D games, as well as the interesting (and sci-fi-ish) Gene Security Network, which Botha describes as helping parents have healthy babies via in vitro fertilization.

Of course, Arrington then asked how close we were to being able to design our own babies, and Botha, taking the question seriously, answered that it was “feasible to some extent today,” but that there’s “just an ethics question.” (Oh you think?)

But the more interesting parts of the interview involved Botha’s vision for entrepreneurs building companies today, and his concerns that not enough are focused on the long road ahead.

Arrington asked Botha to expand on several earlier statements he’s made, where he encouraged tech founders not to sell too early. Botha had said that “people need to be more greedy, and more patient,” for example, and noted that Sequoia “loved being in business with entrepreneurs that want to build something enduring.” He openly pondered what the tech ecosystem would be like if companies like Facebook, Apple and Microsoft had sold out early, too.

Arrington also asked him to list other companies that had sold too early. Botha did say he would always wonder about what would have happened with YouTube had Google not acquired them. “Google has done a fantastic job,” said Botha, who also interestingly noted that YouTube was now profitable.

“Entrepreneurs don’t appreciate when they’re onto a good thing,” said Botha, “the long run can be speculator,” he said. Companies can even see 10x returns after going public, he added, saying that it took LinkedIn eight years to build its business to the scale it is today. Taking a note from Steve Jobs, Botha then encouraged entrepreneurs to build something that “makes a dent in the universe.”

One of the more controversial portions of the chat involved Botha’s discussion of Sequoia’s scout program which PandoDaily recently uncovered. Botha said that the spirit behind the program, which he described as “stealth” but not “secret,” was to give entrepreneurs the chance to make angel investments of their own before they’ve achieved liquidity. Sequoia even had internal discussions about whether or not to make a public announcement about the program, he said. The firm has “a small amount” of money invested in this program and dozens of scouts, but Botha took issue with claims that entrepreneurs didn’t know where the money was coming from. “We always wire the money,” he says, indicating that it would be hard for a startup founder to not know that Sequoia was behind the investments.