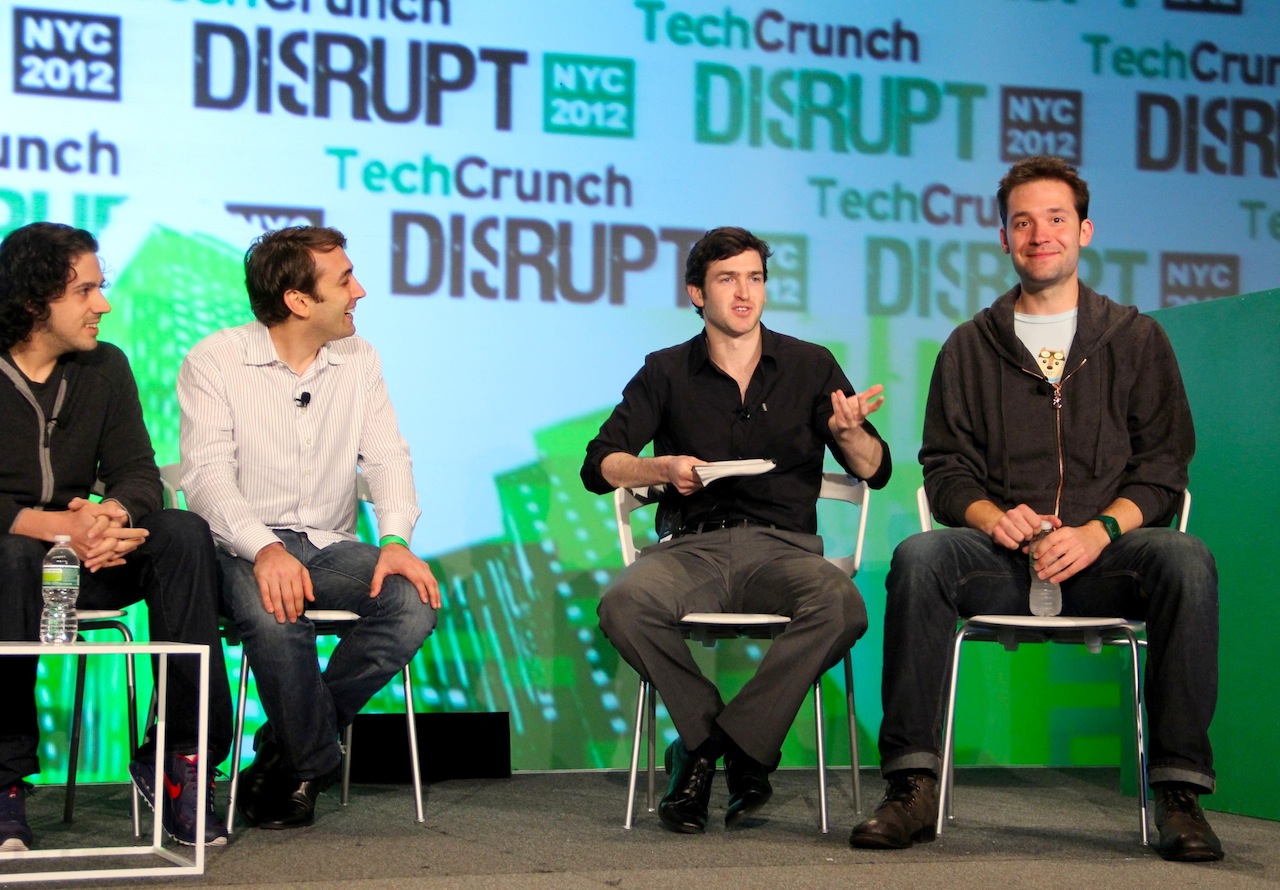

Silicon Valley may be the undisputed capital of tech at the moment, but New York holds its own with a set of unique qualities that make it an essential part of the game — and for some kinds of startups, a much more important base for building a business. These include the city’s population concentration and its leadership in other industries, according to a panel of NY-based tech insiders speaking earlier today at the TechCrunch New York Disrupt conference.

David Tisch, MD of NY-based seed fund and accelerator TechStars, takes that idea one step further: he thinks that this year we will see two or three of the biggest companies based here exit in the form of an IPO or acquisition, out of a group of 20-30 strong candidates that have been “growing to a scale where acquisitions can happen.”

He also noted that it will be “hard to predict” which sectors those would be coming from, and in fact his list of possibilities point to how they are all over the charts — among those to watch, he named companies like Gilt Group, which has built a “tremendous brand”; plus “huge consumer companies” like the blog site Tumblr and the check-in social network Foursquare; and a number of “thriving adtech” startups. “Would it be surprising to see one of these high-growth companies find an exit? No,” he said.

Another one of his co-panelists, the PR supremo Brooke Hammerling of Brew, notes that there are certain industries that have thrived here dating from before the rise of tech: areas like food, fashion and retail, which have “touchpoints into technology but are not tech companies.”

“I think there are certain companies that should be built in New York, taking advantage of what the city has to offer,” adds Tisch, adding that the density of people and business are uniquely suited to certain kinds of business models, where “every stop on the Subway can be a different demographic.” He says: “You can see why a company like Foursquare can take NYC, and own it and thrive here.”

Something he didn’t say but is also true: although there are not really any cities in America quite like New York in terms of its population mix and geography, what is interesting is that it can be a useful test bed for companies looking to expand to other countries that also have dense metropolitan centers.

Alexis Ohanian of Y Combinator and Reddit fame notes that while some believe there is a natural migration of startups from wherever to Silicon Valley — the idea being that you have to be there to really grow — in fact there is a case for some companies moving away from the West Coast to New York, such as the case of recent YC alum Shoptiques, which aggregates inventory from local fashion boutiques and gives them a wider forum online. “They know their business is going to grow here in NY,” he said, pointing to the synergies that naturally exist in a dense city like this one. Shoptiques in March got backing from Andreessen Horowitz and Greylock Partners.

However, back to the question of exits, something that Jake Schwartz, co-founder of NY-based incubator General Assembly, cautioned that it’s not a question of quick turnarounds here: companies are growing and scaling, rather than getting sold just out of seed stage as talent acquisitions. “This is a long game,” he said. “It’s a cycle of generations looking at building up their talent pool and acceptability.” He also noted that in the future it’s likely that startups in the city might not move so fast to the West Coast when they do get bought — instead remaining based here, for SV companies to actually have a better foothold here.

Watch the full panel and post-panel interview below.