ZestCash, a company founded by former Google CIO and VP of engineering Douglas Merrill to legitimize the payday loan industry, is announcing a new patent pending credit decisioning model to better analyze credit risk. ZestCash also introduced Hollerith, a new set of underwriting models that allow the company to extend credit to 25 percent more Americans and increase repayment from customers by 20 percent.

ZestCash takes an entirely different approach to underwriting by combining Google-style machine learning techniques and data analysis, combined with traditional credit scoring. As a result, the company can offer credit to many people who historically would have been turned away. The company allows users to borrow between $300 and $800 in what are called “installment loans” and is currently available in five states— Wisconsin, Utah, Idaho, Missouri and South Dakota.

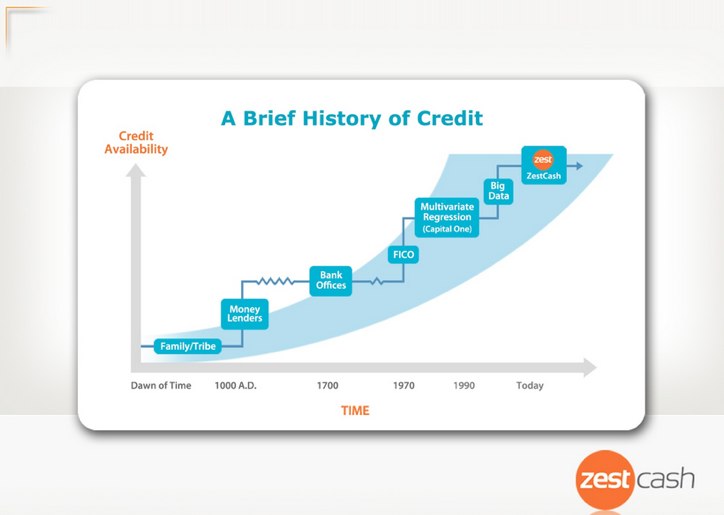

Traditionally, lenders have used single regression models that analyze approximately fifteen points of data to make credit decisions. When ZestCash launched two years ago, it began applying big data analysis to underwriting for the first time. Now, instead of employing just one underwriting model, the ZestCash decisioning infrastructure can run dozens of models in parallel, returning loan decision results within seconds.

Basically, ZestCash used to run one big data underwriting model that looked at up to a thousand variables. This new infrastructure lets it run multiple big data models in parallel, so it can look at more data points to more accurately determine whether a person is a good candidate for credit.

ZestCash now runs about 10 unique underwriting models simultaneously that consume thousands of raw data elements including third-party data and data collected from borrowers. The models then transform this data into tens of thousands of useful meta variables to assess key customer behaviors such as fraud, short-term and long-term credit risk, or the amount of money a borrower will likely repay. The models are then “ensembled” to arrive at a final underwriting decision that more accurately predicts credit risk. Some of this data includes cell phone contract credit history and rental information.

Shawn Budde, ZestCash Co-founder and Chief Operating Officer adds that the new modeling has helped increase customers’ net payback by 20 percent.

Since the company‘s launch one year ago, ZestCash has helped more than 10,000 customers who have borrowed nearly $10 million dollars from the company. ZestCash just raised $73 million in funding in January.