Jetsetter, the exclusive travel community for globetrotters, seems to be on a roll. In recent days, the company has announced a dozen some new corporate partners, a handful of new sale formats to entice customers, and new distribution partnerships with high-profile sites like Kayak, The Economist and the vacation rental service HomeAway.

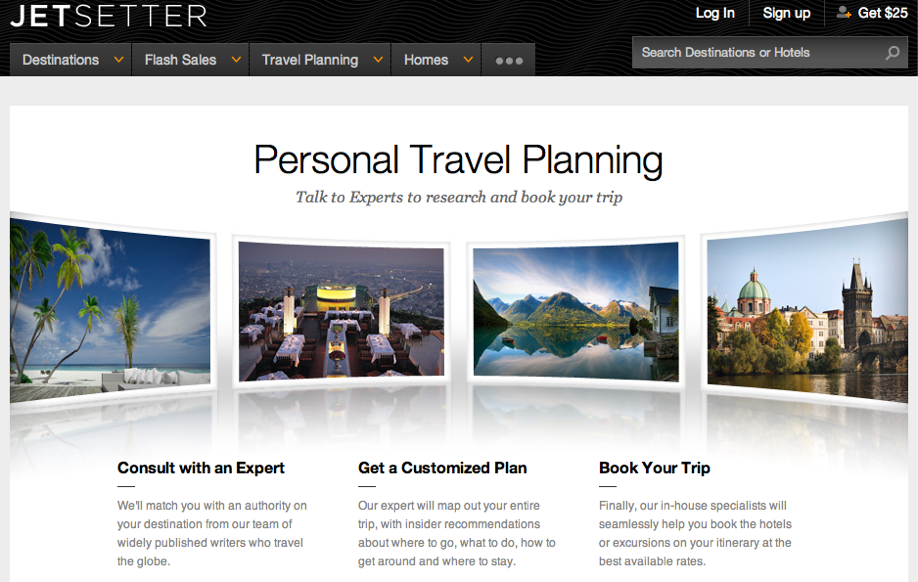

But while many think of Jetsetter as a flash sales for travel site, it’s been finding growth in other verticals: curated recommendations and personal service.

Launched back in September 2009, Jetsetter was the first flash sales site for travel, and has now outlasted much of its earlier competition. Unlike online travel bookings sites aimed at helping users find the cheapest flights and hotel rooms, Jetsetter’s angle is different. It targets not the everyday traveler, but the affluent one.

“Jetsetter customers tend to be six-figure incomes, college-educated professionals, and they tend to come from major urban markets – New York, San Francisco, L.A., Boston, Chicago,” explains Jetsetter CEO and founder Drew Patterson. “These are people for whom travel, and their experiences in travel, are an important part of their sense of self,” he says.

“Jetsetter customers tend to be six-figure incomes, college-educated professionals, and they tend to come from major urban markets – New York, San Francisco, L.A., Boston, Chicago,” explains Jetsetter CEO and founder Drew Patterson. “These are people for whom travel, and their experiences in travel, are an important part of their sense of self,” he says.

Targeting the elite customer has, so far, paid off. Jetsetter now has 2.2 million members, and has sold over half a million room nights worldwide. On the company’s website, members can take advantage of flash sales on travel, which offer savings of up to 50% off. The site runs anywhere from 20 to 40 of these sales per week. There’s also an online concierge service for bookings to help customers with travel planning.

The available inventory for travelers now includes over 650 hotels and resorts in Jetsetter 24/7, its full-price retail offering, which today accounts for over 30% of the company’s revenue. There are also nearly 300 homes in Jetsetter Homes, an increasingly popular vertical for the company, with 500 more in the process of being added.

“The non-hotel category of lodging has been exploding,” says Patterson, noting consumers’ interest in companies like Airbnb and Inspirato, for example. “Consumers are hungry for something other than hotels. It’s nice to have common space, a kitchen and living room versus bedroom,” he adds. But Patterson says that it’s still hard to book vacation homes online, not only because there aren’t many systems that support online booking, but also because of security issues.

“There are concerns and risks around financial settlement,” he says. “Typically you’re wiring funds with a homeowner, and you’ve never met this person before. You haven’t seen the product before. There’s a fair amount of risk and uncertainty involved in that.”

Jetsetter wants to step in to be the middleman for those transactions, taking on the financial risk, he says. They curate and vet the properties, even going onsite to visit them. That helps to establish trust with their users.

In addition to vacation rentals, Jetsetter’s personal travel planning offering executed 600 trips last year, despite having only launched in June. Today, there are approximately 400 trips in progress, which consumers booked thanks to the recommendations from Jetsetter’s network of over 200 correspondents – experienced travel experts and writers who visit the hotels and partners on Jetsetter’s behalf.

It’s this focus on curation, personalization and recommendation that’s proving to be a growing part of Jetsetter’s business. One third of the company’s revenue came from retail in January, as customers seem willing to pay full price when recommendations are involved.

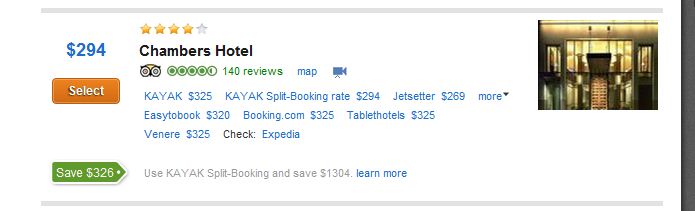

Jetsetter is also going after customers through other verticals, specifically through new distribution partnerships like travel site Kayak.com which will see all 650 Jetsetter hotels made available for bookings, as well as with the vacation rental website HomeAway, which is testing Jetsetter integration with 150 homes. The company is also working with The Economist on an exclusive 6-week campaign of flash sales curated for the outlet’s readers, which includes distribution through The Economist’s homepage, newsletters, social media and mobile.

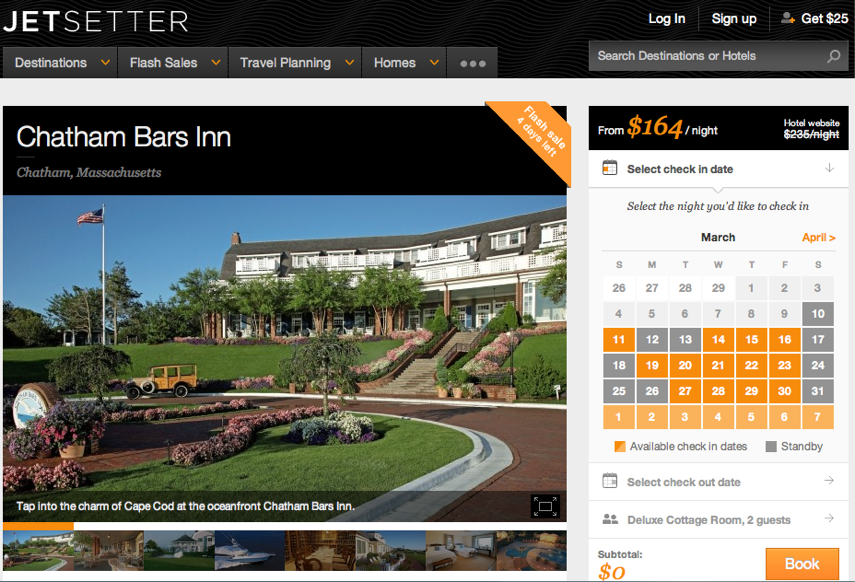

New sales formats have been recently introduced to provide a variety of experiences for Jetsetter customers. One, the “Mystery Monday” model, will provide deeper discounts to customers willing to book before learning the hotel’s name. It’s not all that unlike the blind bookings Priceline offers, but the hotels selected are of high quality, like The Ritz-Carlton, the Four Seasons, and The Surrey, all of which made an appearance in January.

There are also two-to-three night getaways called Jetsetter Weekends, focused on a collection of inns and B&B’s outside of Jetsetter’s top seven markets (N.Y., Boston, D.C., Miami, L.A., San Francisco, and Seattle). Meanwhile, new “Style Steals” offer discounted rooms at hip, boutique hotels. Jetsetter also says it occasionally runs sales for properties that prefer the voucher format like the Trump Hotel Collection, The Peninsula Hotels, Marquis Jets, and Groundlink, for example.

With all these sales formats combined, it seems that you can no longer call Jetsetter just a “flash sales site” for travel, even though it has an association with sister site Gilt Groupe, known for its flash sale properties.

“We obviously have a flash sale part of the business. That’s hugely important because that was our roots,” says Patterson. “But we also found that customers would write us early on and say, ‘I missed the sale. You emailed me something last week and it seemed great, but it’s not up there anymore. Just tell me what it was. It looked great and I want to go buy it.'”

“We said, Huh?'” he laughs. “But we had enough of these that it seemed like consumers really seemed to trust our judgment. That judgment is an important part of our business and our brand.”

And flash sales?

“Flash sales can inspire consumers and give them ideas for where they should go,” he says.