You know what’s awesome about today? Facebook just revealed its financials in preparation for public offering.

Bear with me: This means no more “leaks” of Facebook’s revenue numbers to spike its valuation in secondary markets. No more banal and vague conversations about how Facebook is “killing it” at San Francisco bars. It means that I’ll never have to write another one of these “Report: Blah Blah Blah” posts about Facebook revenue using this Zuckerberg dollar graphic I made for Mike.

(Maybe I’ll repurpose the graphic for use in one of the inevitable posts we’ll write trying to pinpoint the company’s valuation and strike price. Get ready for the deluge of these until the thing actually goes public in April.)

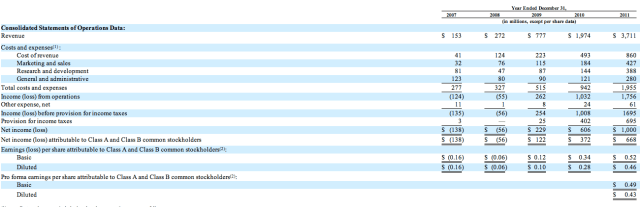

So now all this “how much money Facebook makes?” cat is out of the bag! According to the S-1, Facebook made a modest $382,000 in revenue 2004, $9 million in revenue in 2005, $48 million in revenue in 2006 and $153 million in revenue in 2007, with no reporting of net loss.

Facebook does reports loss for revenue numbers post 2006: It made $153 million in revenue in 2007, with a $138 million loss, $272 million in 2008 with a $56 million loss and was finally profitable in 2009 with a net income of $290 million on $777 million in revenue.

For those of you that are fact checking enthusiasts: The $777 million and $290 million number falls in line with press reports, and analysts were also right about Facebook’s $2 billion in revenue and $606 million in net income for 2010.

However sundry reports were all over the map for 2011 revenue (it was actually $3.7 billion), but hit the $1 billion in net income right on the head.

Man, a billion dollars in profit for what is basically pushing pixels. Anyone have an in at Facebook?

https://twitter.com/#!/alexia/status/164847708329361408