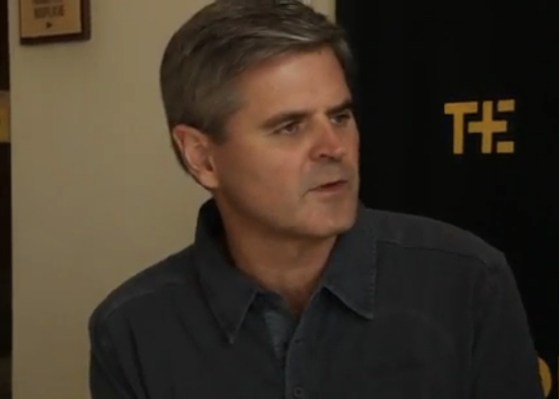

AOL founder Steve Case has a three-point plan to get job growth back on track in America, and it all revolves around ways the government can spur more entrepreneurship. Over the past three decades, high-growth companies created 40 million jobs. “It accounts for all the net job creation,” Case tells me in the video interview above.

I sat down with Case yesterday at the Techonomy conference. Case is the chairman of the Startup America Partnership and sits on the White House Jobs Council. He thinks the U.S. should:

1. Reform its immigration policy to make it easier for skilled workers and entrepreneurs to come to this country. “We are losing the global battle for talent,” he says.

2. Unlock access to capital by making crowdfunding legal and changing capital gains for certain types of investments

3. Change regulations and Sarbanes-Oxely to make it easier for smaller companies to go public.

His crowdfunding proposal would require the government to relax the rules around accredited investors (i.e., wealthy individuals) being the only ones allowed to invest in private companies. Some crowdfunding proposals out there would allow anyone to invest up to $10,000 in a private company without being an accredited investor. “It seemed crazy to me that you have to be an accredited investor to invest in a company,” says Case, “but you can go to Las Vegas and lose $10,000 at the table in an hour but you don’t have to be an accredited gambler to do that.”

More startups will create more jobs. Case also thinks the threshold for Sarbanes-Oxley reporting requirements for public companies should be raised from today’s $75 million market cap to only kicking in for companies with $1 billion or more of market value. When he took AOL public the first time twenty years ago, “80 percent of offerings were under $50 million.” Now it’s the reverse. Smaller companies simply aren’t going public, they are being sold instead. And that actually hurts jobs, because “job growth decelerates” after most acquisitions, says Case. He adds that “90% of job growth is after a company goes public.”

In the video clip below, Case talks about the “Second Internet Revolution” and the sharing economy that he is personally investing in with LivingSocial And Zipcar. (He talks more about LivingSocial and Groupon in this third outtake here). We also discuss why Internet startups haven’t yet had a big impact on sectors like education and healthcare.

(TechCrunch is owned by AOL, although Case is no longer involved with the company).