Y Combinator alum ReadyForZero is rolling out an upgrade to its debt management service today, with new features that will now allow its users to centralize and manage more of their debt using its online application. Previously, the company was focused only on reducing consumers’ credit card debt. Now it’s adding support for mortgages, auto loans and student loans, too.

At first glance, ReadyForZero may be mistaken for a competitor to the online money management service Mint. But where Mint helps you gain insight into your spending behaviors, ReadyForZero is more narrowly focused on helping your actively pay down your debt. Like Mint, it automatically imports data from your bank accounts, credit card accounts and now loans, but it uses this information to actively make recommendations as to when you’re able to make extra payments in order to save on interest. It can also alert you to the repercussions that recent big-ticket purchases will have on your plans to pay down your debt within a given timeframe, and can suggest ways you can get back on track.

More importantly, however, is that the system works. As MG reported this summer, regular users of ReadyForZero’s service are getting out of debt twice as fast as irregular users.

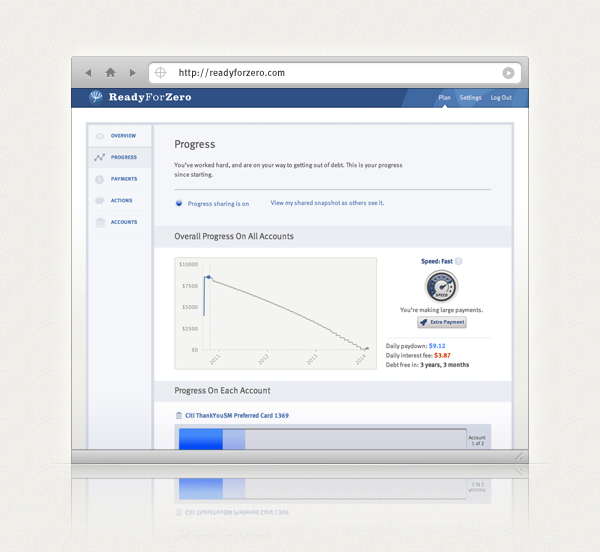

In addition to the added support for loan management noted above, the ReadyForZero user interface has been tweaked to include some new features, like a “speed” gadget that shows you how much faster you’re paying off debt by making extra payments. The tool aims to help you better visualize the adjustments you’re making to your payment plans.

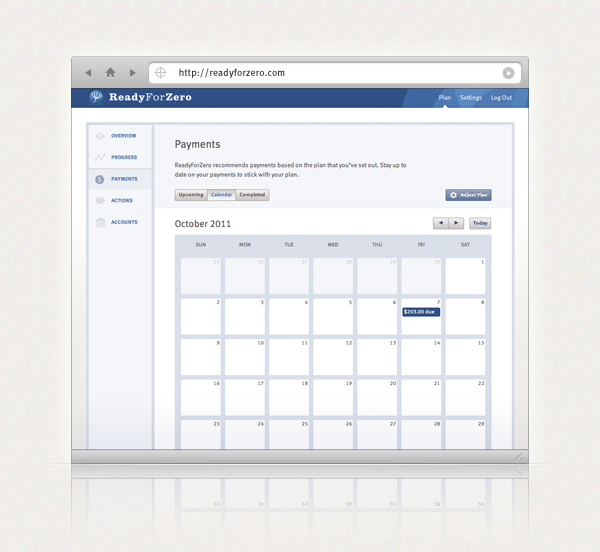

The site also now includes new suggested actions that give you tasks to complete, like setting up payment reminders to sync with your calendar or linking your accounts, among other things.

The “share your progress” feature has been expanded, too, so you can provide an anonymized URL that provides a snapshot of your progress on debt reduction to lenders and banks in need of proof of your efforts.

According to Co-founder Rod Ebrahimi, the startup is already fielding inquires from two of the top five banks for consumer debt. The banks want to know how they can take advantage of the service’s offerings to help their customers restructure their debt so as to reduce the banks’ risk. At any given time, Ebrahimi explains, 10% of of these banks’ debt is at risk. Or, in other words, tens of billions of dollars.

ReadyForZero is now working with some of these banking institutions now to test how the service can provide its users with access to banks’ own products and programs that could help them further reduce their debt. Also on the roadmap are plans for automating payments and a set of mobile applications.

In June, ReadyForZero raised $4.5 million in Series A funding led by Polaris Venture Partners with participation from Citi Ventures. This followed an earlier $260,000 seed round featuring prominent angels like Steve Chen, Dave McClure, Benjamin Ling, Nils Johnson, and Maneesh Arora.