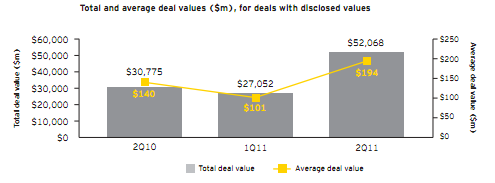

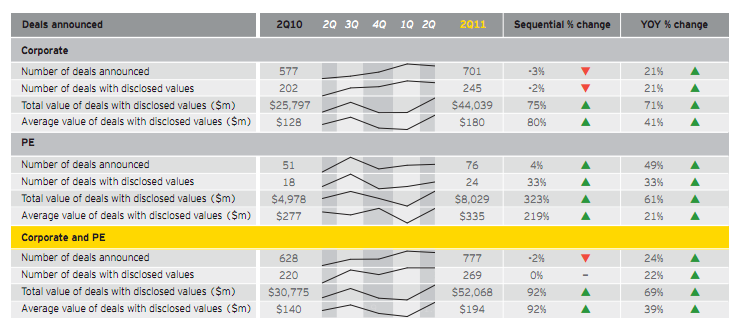

While tech company IPOs have captured buzz of late, it looks like M&A activity in the sector has been booming. According to an Ernst & Young report, big deals drove the aggregate value of global technology M&A to $52.1 billion in the second quarter of 2011, nearly doubling the deal value from the first quarter (up 92 percent to be exact).

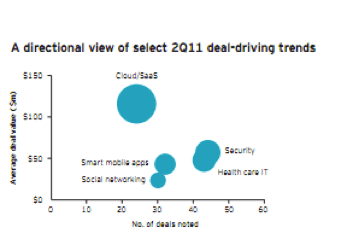

Ernst & Young said that the surge was attributed mainly to industry consolidation and by ongoing innovations in areas such as cloud computing, smart mobility, internet and mobile video, the smart grid and solar energy.

Overall, deal volume for the quarter increased 24% year-over-year (YOY) to 777 deals, but declined 2% sequentially from 794 deals in 1Q 2011. It was the first sequential quarterly decline since 1Q 2009.

This past quarter’s M&A value was 69% higher than the same quarter in 2010, when M&A deals were valued at $30.8 billion. The average value for deals in Q2 with disclosed-values rose to $194 million, which is the highest quarterly average since the first quarter of 2000, during the dot-com boom. Q2 2011 also includes the 20th-largest global technology deal ever by dollar value (perhaps the $8.5 billion cash acquisition of Skype by Microsoft?).

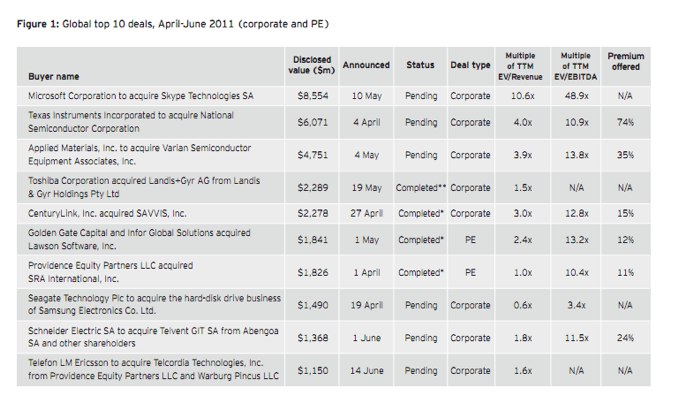

The report also shows that although 61% of all disclosed value was concentrated in the top 10 deals, the tech industry also saw significant deal-making strength in deals of less than $100 million.

Microsoft-Skype was the largest deal in the quarter, followed by Texas Instrument’s $6.5 billion acquisition of National Semiconductor. Other big-ticket deals for the quarter included Applied Materials $4.6 billion acquisition of Varian Semiconductor and Toshiba’s $2.3 billion buy of Landis.

In particular, Semiconductor M&A brought in $10.9 billion in the quarter and cloud computing and SaaS companies continued to drive both large and small deals. For example Century Link bought Savvis for $2.3 billion in the quarter.

More companies are also looking outside their own countries for acquisitions. Ernst & Young’s data shows that ‘cross-border’ deal volume in 2Q 2011 was 16% higher sequentially, compared with an 11% decline in ‘in-border’ deals. The report suggests that increasing globalization and the growing volume of “overseas” cash stockpiled by US-based companies may be behind the increase in CB deal-making as the US acquired 56% of all CB value acquired.

Some of the other larger M&A deals in the second quarter include EA’s $1.3 billion purchase of PopCap games, Providence Equity’s $1.6 billion acquisition of BlackBoard, Epicor and Activant’s nearly $2 billion deal, and Level 3’s $3 billion acquisition of Global Crossing.