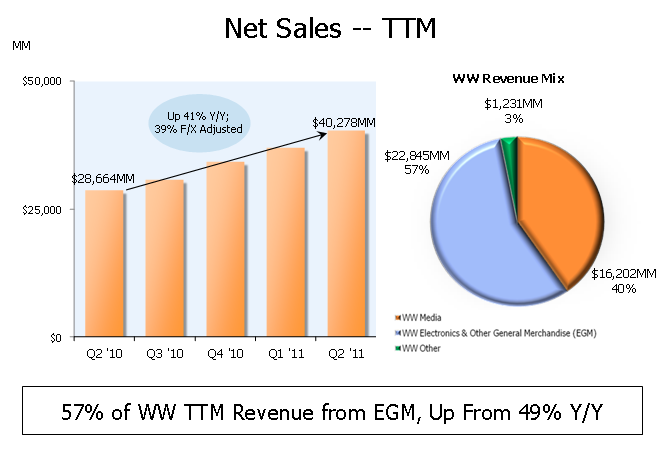

E-commerce giant Amazon just reported second quarter results, posting sales of $9.9 billion, an increase of 51 percent from the same quarter in 2010. Net income decreased 8% to $191 million in the second quarter, or $0.41 per diluted share, compared with net income of $207 million, or $0.45 per diluted share, in second quarter 2010. Analysts expected strong sales of $9.37 billion but earnings were expected to drop to $0.35 cents per share for net income.

The Kindle 3G with advertising is now the company’s bestselling Kindle, says Amazon. Amazon founder and CEO Jeff Bezos said in a statement: “Low prices, expanding selection, fast delivery and innovation are driving the fastest growth we’ve seen in over a decade…Kindle 3G with Special Offers has quickly become our bestselling Kindle at only $139. Customers love the convenience of a 3G reader — no hunting for or paying for Wi-Fi hotspots. Amazon picks up the tab for the 3G wireless, so you have no monthly payments or annual contracts.”

Amazon says that second quarter 2011 net income was actually positively impacted by an equity-method investment activity of $15 million, including a $49 million gain on the sale of an equity position that was offset by $34 million in losses from equity-method investments.

Unsurprisingly, Amazon says that sales growth of Kindle devices accelerated in second quarter 2011 compared to first quarter 2011 but declined to give set numbers on how many Kindles were sold in the quarter.

Operating income was $201 million in the second quarter, compared with $270 million in second quarter 2010. The favorable impact from year-over-year changes in foreign exchange rates throughout the quarter on operating income was $28 million.

Specifically, North America segment sales were $5.41 billion, up 51% from second quarter 2010.

International segment sales, representing the Company’s U.K., German, Japanese, French, Chinese and Italian sites, were $4.51 billion, up 51% from second quarter 2010. Worldwide Electronics and Other General Merchandise sales grew 69% to $5.89 billion.

In terms of third quarter guidance, sales are expected to be between $10.3 billion and $11.1 billion, or to grow between 36% and 47% compared with third quarter 2010. Operating income is expected to be between $20 million and $170 million, which is a 93% decline and 37% decline compared with third quarter 2010.

We’ll listen to the earnings call and update you with any additional information.