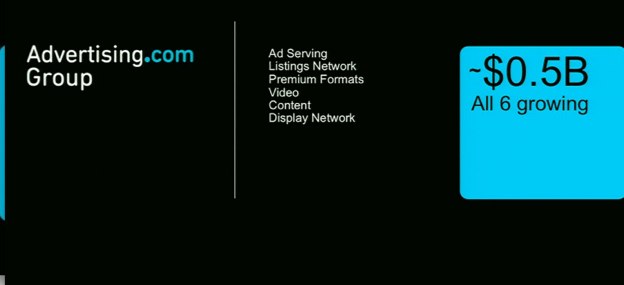

AOL’s advertising platforms, which are grouped under the Advertising.com business, is now a $500 million business, the company revealed today at its Investor Day in New York City. The Advertising.com Group is a new business unit inside AOL, which includes six separate products: The Advertising.com ad-serving network (which AOl acquired in 2004) and AdTech, along with more recent acquisitions 5Min (now AOL Video), Pictela, GoViral, and the internally built Seed product. (AOL also owns TechCrunch, but we are part of the Huffington Post Media Group).

All of that, all together is a $500 million business, which is about a quarter of AOL’s total revenue. And it’s clear that AOL thinks it can become a $1 billion business. Today was the first time AOL broke out these numbers.

AOL is trying to position itself as the best place for brands to advertise next to premium content. It is trying to do this first on its own sites, primarily with its Project Devil ads. But the bigger play is to become the ad network for premium brands across the Web by extending Project Devil ads and other new ad formats to the 26,000 publishers on AOL’s ad network.

And in fact, through Pictela, AOL is going to expand its highly engaging Project Devil Ads out across what it is calling the Devil Network. Devil Ads are larger-format ads that can include video or photo galleries, maps, or other interactive elements. AOL is seeing very high engagement rates with these ads, sometimes as high as 10 percent. Devil ads are just one format. Expect AOl to move into mobile ads and other formats as well.

AOL’s entire focus is to create branded experiences for big brand marketers. That includes putting those ads next to great content, but it also means rethinking the boring, old banner ad. Ned Brody, who runs the Advertising.com group, sees the opportunity this way: “There is $50 billion sitting in a locked vault, television and print. It is hard to convince advertisers to take that to a market where they get 0.2% clickthrough rates.”

In order for this plan to work, however, other sites will have to change their designs to be able to accept the bigger Devil ads. If they in fact do perform better, they might do that. But adoption will be a challenge. (Other Devil ads fit into standard 300X250 and 300X600 ad units).