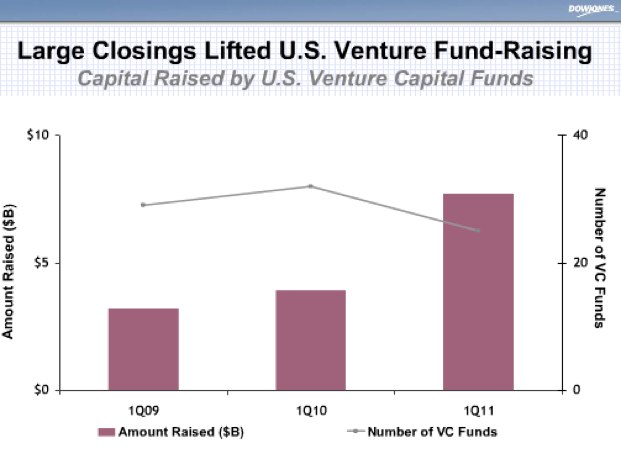

U.S. venture capital firms raised more money last quarter than in any period since 2001. The total raised for new funds was $7.7 billion, according to Dow Jones LP Source. The capital going into VC funds was up 97 percent from a year ago, when they raised $3.9 billion. (Venture capital funds benefited from an overall influx of money into U.S. private equity funds overall, which attracted a total of $31.6 billion in the quarter, up from $13.5 billion a year ago).

Institutional investors and limited partners are putting more money into ventre capital, but are concentrating their bets in fewer, higher-quality funds. The money from limited partners, however, was not spread willy-nilly. Only 25 funds tracked by Dow Jones were able to raise money, the smallest number since 2003.

A few, well-known firms were able to raise substantial amounts. Bessemer closed a $1.6 billion fund, Sequoia closed a $1.3 billion fund, and Greylock added a $1 billion fund.

Early-stage funds attracted the most new capital, accounting for $3.9 billion of the total, up from $736 million a year ago. Later-stage funds collected only $1.5 billion, and multi-stage funds raised $2.3 billion.

European VC funds didn’t do so well, raising only $653 million across five funds, down from $1.3 billion a year ago across 13 funds.