Y Combinator-backed startup ReadyForZero, a startup that helps Americans cleanse themselves of credit card debt, is taking its debt management platform public today. Launched in private beta last year, ReadyForZero is trying to help those consumers who are having trouble paying their debt off, as opposed to those who are already in collections or bankruptcy. Essentially the site uses a Mint.com model to help people not carry any balances month to month.

Consumers sign onto ReadyForZero with their credit card accounts and passwords (leveraging Yodlee), and similar to Mint.com, the startup will evaluate all of the balances and minimum balances and give users a 360-degree view of their financial situation.

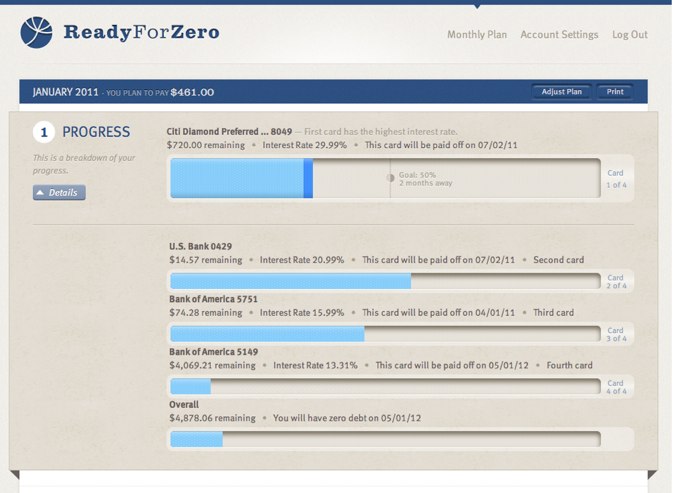

ReadyForZero will build a personalized plan for consumers, charting out how much interest is being charges on each credit card account, minimum payments and when each card’s balance will eventually be paid off. Based on your minimum payments, salary and balance, ReadyForZero will figures out an optimal strategy for what to pay and when. And qualified ReadyForZero members can obtain lower-interest, fixed-rate

personal loans through the startup’s partnership with peer lending site Lending Club.

The startup, which just raised $260,000 in new funding, seems like it could be complimentary to personal finance management Mint.com.