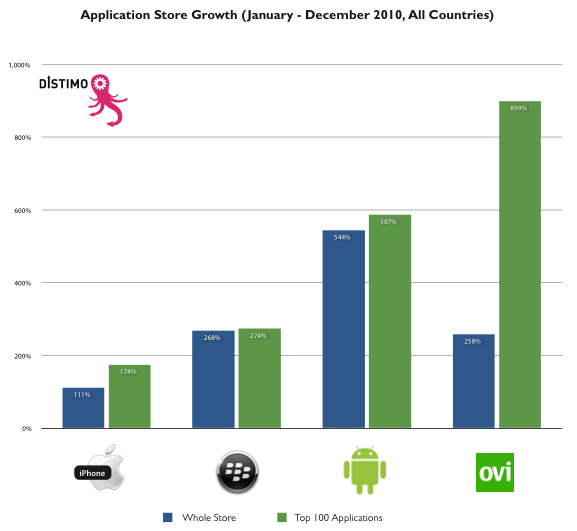

Last year, the world went app crazy. If anything, 2010 was the year of the mobile App Store—not only for Apple, but also for Android, Blackberry, and even Nokia. App store analytics firm Distimo has a new report looking at Great Mobile App Store Boom of 2010. While Apple ended the year with roughly 300,000 apps in iTunes, the Android Market grew to about 130,000, while Nokia’s Ovi Store got to 25,000 apps and BlackBerry App World reached 18,000. The number of apps in iTunes doubled, but the smaller app stores grew even faster, with the number of Android apps up 544 percent, Blackberry apps up 268 percent, and Nokia apps up 258 percent.

Angry Birds is the most popular app across all mobile platforms, while Facebook is the most popular non-game app. Distimo also found that the categories with the strongest growth on the iPhone were serious business apps (up 186 percent) and medical apps (up 156 percent), whereas the fastest-growing categories on Android were more frivolous: comics (up 802 percent), card and casino games (up 644 percent), and entertainment (up 589 percent). Go figure.

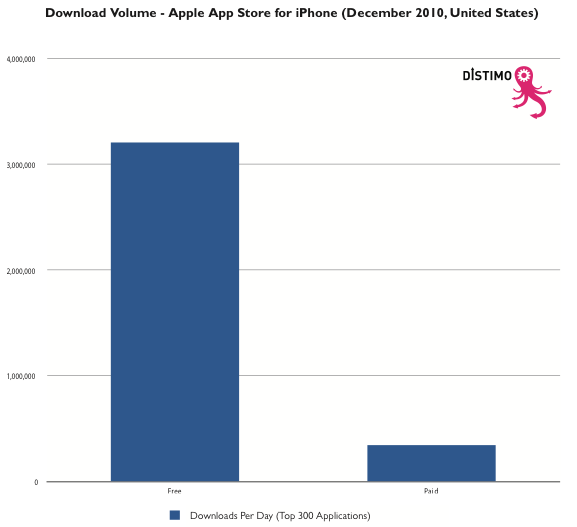

The most interesting data in the report, though, comes from trends in the Apple App Store, especially looking at the difference between paid and free apps. Free apps are downloaded nearly ten times as much as paid apps. On average, the top 300 free apps in iTunes were downloaded 3 million times a day, versus 350,000 downloads a day for paid apps.

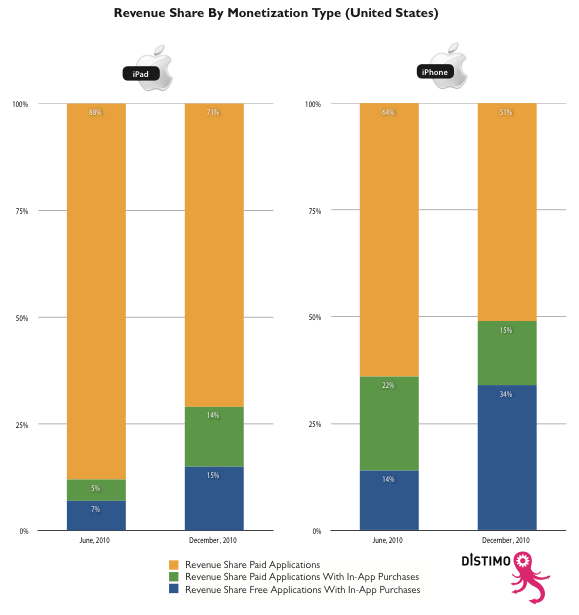

As in-app purchases took hold in the App Store (see ngmoco), the percentage of revenue coming from apps with in-app purchases grew significantly. Between June and December of last year, the share of revenues among the top-grossing iPhone apps coming from free apps with in-app purchases went from 14 percent to 34 percent. For iPad apps, that percentage was lower, going from 7 percent to 15 percent.

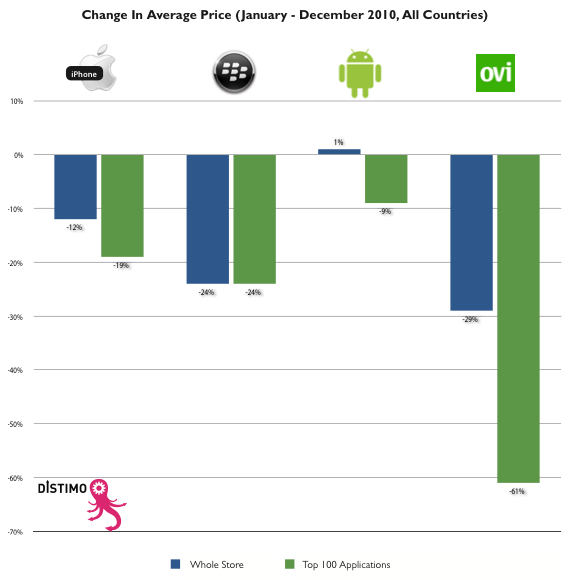

Paid apps without any in-app purchases still rule on the iPad, accounting for 71 percent of revenues for top-grossing apps. On the iPhone, pure-vanilla paid apps only account for 51 percent of revenues. The average price of apps declined 12 percent last year in Apple’s App Store, and the downward pressure was even greater in the other app stores,with the sweet spot settling between 99 cents and $2.99. For Apple, paid apps with in-app purchases account for almost as much revenue on the iPad (14 percent) as free apps with in-app-purchases. Whereas that segment is being squeezed on the iPhone. But remember that iPad apps have not been around as long. As the iPad becomes more mature, I suspect the revenue distribution will look more like the iPhone apps.