There is a lot of hype swirling that 2011 is going to be the big comeback year for the venture-backed IPO. And we’re talking about big, gaudy IPOs, not small ones that essentially function as another funding round. And interestingly, pundits and investors expect some new $1 billion companies to debut in both cleantech and Internet sectors.

There is a lot of hype swirling that 2011 is going to be the big comeback year for the venture-backed IPO. And we’re talking about big, gaudy IPOs, not small ones that essentially function as another funding round. And interestingly, pundits and investors expect some new $1 billion companies to debut in both cleantech and Internet sectors.

So maybe the fourth quarter was just the calm before the frenzy? Let’s hope so, because it wasn’t great, according to Dow Jones VentureSource’s quarterly liquidity report issued this morning.

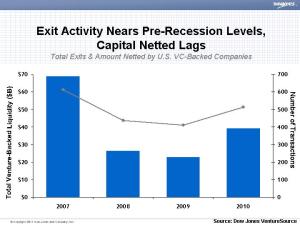

Overall in 2010, the number of exits increased 25% from 2009, but considering the economic state the world was in two years ago, that’s not saying a lot. In all 514 companies went public or got acquired in 2010, netting some $39.3 billion in capital. Those totals still fell short of the 613 companies that exited 2007– the last decent year on record.

Most of 2010’s gains over 2009 happened in the first nine months of the year. In the fourth quarter specifically, 126 acquisitions and IPOs netted just under $12 billion, a small increase over the year earlier period when 123 exits netted $11 billion. Acquisitions actually fell 7% in the fourth quarter of 2010 over the fourth quarter of 2009.

But at least on a year-over-year basis the exits are getting a lot bigger. In 2010 companies returned 72% more money than the companies that exited in 2009, although at just south of $40 billion it’s about 40% less than the $69.1 billion returned to investors in 2007.

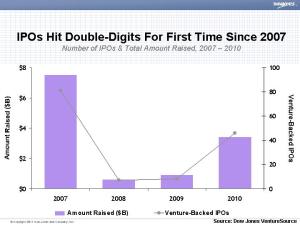

What accounts for the dramatic increase in money while the number of deals was just up 25%? The relative return of the IPO. I say “relative” because we’re still not talking about good numbers given the amount invested each quarter in new companies and the paltry track record of IPOs for most of the last decade. But for the first time since 2007, the number of IPOs actually hit double digits. Forty-six venture funded companies went public in 2010, raising $3.4 billion– up more than five times from the year earlier’s proceeds from a paltry eight IPOs. And there are 44 companies in registration, up from 25 this time last year, says Jessica Canning, director of global research for Dow Jones VentureSource.

Although most startups will exit via acquisition, IPOs are crucial. Without them, the venture-backed ecosystem doesn’t get the next generation of tech giants to do future acquisitions, and the threat of an IPO drives up the acquisition prices.

But here’s an important thing to consider amid the inevitable “HAPPY DAYS ARE HERE AGAIN!” some VCs will be spinning once these numbers are released: Despite the surge of super angels and widespread belief that it takes less money and less time to build a company today, companies are taking more money and longer to go public than ever before.

According to Dow Jones, the medium amount of venture capital raised prior to an IPO rose 60% to $69 million in 2010 and the median amount of time it took a company to go public rose to more than eight years. The time to exit has been steadily marching up year-after-year, which is a combination of the economy, post-2000 changes on Wall Street, and founders’ reluctance to file. The venture-backed economy is rapidly becoming polarized between quick flips or a long, hard-fought slogs even for the hottest companies.

Even if the wildest hopes for 2011 IPOs turn out to be true, those two metrics will no doubt increase with some of the biggest contenders being decade-old startups like LinkedIn and Pandora and companies that have raised un-Godly amounts of funding like Groupon, Facebook and Zynga. It’s like David Hornik argued in our VC v. Angel smackdown last fall: Building a product is easier and cheaper than ever but building big Internet companies still takes time and a “shit-load of money.”

One final note as a hat-tip to Benchmark’s Bill Gurley: The Valley may be the biggest ecosystem, but the biggest deals still didn’t come out of Silicon Valley. The largest IPO of the year was a $211 million offering by New York-based FXCM, a foreign exchange trading firm, and the largest acquisition was a $1.2 billion purchase of Dallas-based Monitronics International, which makes security systems.