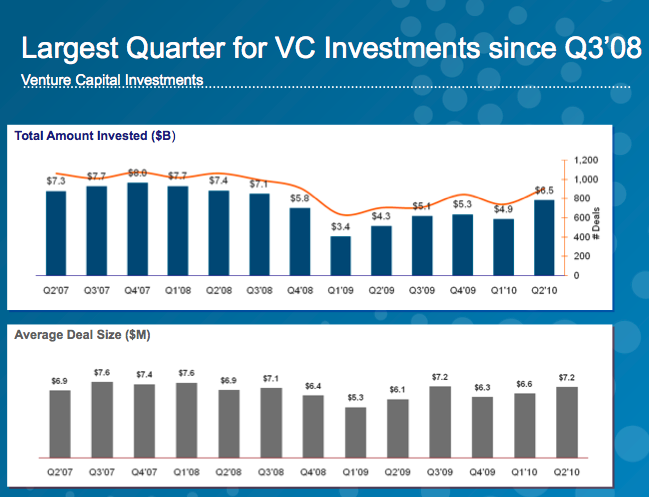

Venture capitalists invested $6.5 billion in 906 deals in the second quarter of 2010, according to a MoneyTree Report from PricewaterhouseCoopers LLP and the National Venture Capital Association, based on data provided by Thomson Reuters. Quarterly investment activity increased 34 percent in terms of dollars and 22 percent in number of deals compared to the first quarter of 2010 when $4.9 billion was invested in 740 deals.

In the first half of 2010, VC investments totaled $11.4 billion in 1,646 deals, a 49 percent increase in dollars and a 23 percent increase in deals from the first half of 2009, in the mist of the recession, when $7.7 billion was invested in 1,340 deals.

The Software industry had the most deals completed in Q2 with 229 rounds, representing a jump of 43 percent from the 160 rounds completed in the first quarter. In terms of dollars invested, the Software sector was in third place, increasing 43 percent from the prior quarter to $1 billion in the second quarter of 2010.

Internet-specific companies received $879 million going into 212 deals in the second quarter, flat in terms of dollars and a 25 percent increase in deals over the first quarter of 2010 when $891 million went into 169 deals. ‘Internet-Specific’ is a discrete classification assigned to a company with a business model that is fundamentally dependent on the Internet, regardless of the company’s primary industry category.

Investments in the clean tech sector doubled in the second quarter compared to Q1 of 2010. The sector saw a 107 percent increase in dollars over the first quarter to $1.5 billion in 71 deals compared with 70 deals in the first quarter. The life sciences sector jumped 52 percent in dollars and 36 percent in deals from the prior quarter to $2.1 billion going into 234 deals. Biotechnology again received the highest level of funding, rising 59 percent in dollars and 34 percent in deal volume in the second quarter with $1.3 billion going into 139 deals. Medical device investing also increased 40 percent in both dollars and deals over the first quarter with $755 million going into 95 deals in Q2.

The Industrial/Energy industry received the second highest level of funding in the quarter with $1.3 billion going into 61 deals, representing a 95 percent increase in dollars but a 13 percent decrease in deals compared to the first quarter when $658 million went into 70 deals. In all, 11 of the 17 sectors experienced dollar increases in the second quarter, including Computers and Peripherals (48 percent increase), Consumer Products and Services (44 percent), and IT Services (28 percent). Sectors which saw decreases in dollars included Semiconductors (40 percent decrease), Financial Services (22 percent) and Telecommunications (27 percent).

Seed and early stage deals also increased in Q2 from prior quarters, rising 54 percent in dollar value to $2.3 billion. The actual number of Seed and Early stage deals increased 32 percent to 429 from the prior quarter. Seed/Early stage deals accounted for 47 percent of total deal volume in the second quarter, compared to the first quarter when it accounted for 44 percent of all deals. The average Seed deal in the second quarter was $7.1 million, up from $5.1 million in the first quarter. The average Early stage deal was $4.7 million in Q2, up from $4.4 million in the prior quarter.

Expansion stage dollars increased 48 percent in the second quarter, with $2.7 billion going into 277 deals. Overall, Expansion stage deals accounted for 31 percent of venture deals in the second quarter, down slightly from 32 percent in the first quarter of 2010. The average Expansion stage deal was $9.7 million, up from $7.6 million in the first quarter of 2010.

These numbers create an optimistic view of the venture capital sector that is not reflected in another recent National Venture Capital Association study that showed that most U.S. venture capitalists expect their market to contract. And while, fundraising is on the rise, long terms returns are hurting.