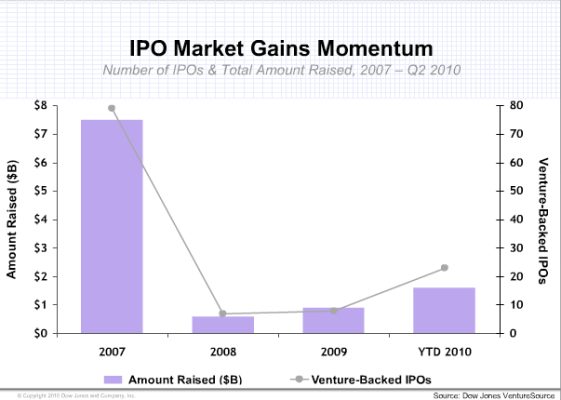

The beloved, endangered IPO is showing signs of revival, or at least survival. In the second quarter of 2010, there were 15 venture-backed IPOs in the U.S., which raised a total of $899 million, according to data released today by Dow Jones VentureSource. The amount raised is nearly four times as much as the same, admittedly moribund, period a year ago, when there were only 3 IPOs and $232 million in exits. So far this year, the total number of IPOs (23) and exit dollars ($1.6 billion) already surpasses the totals for each of the last two years.

Of course, the IPO markets are coming back from a near-death experience so the comparisons look great. The numbers got a big boost from the Tesla IPO on Tuesday, which raised $202 million. (The shares are trading at $24 this morning, 41 percent above the IPO price).

But the IPO market still has along way to go. The total number of IPOs and money raised is still a fraction of what it was even in 2007, when there were nearly 80 IPOs and more than $7 billion raised. It’s also never taken longer for a company to go public (at least over the past 18 years since VentureSource has been keeping track). The median time between founding and IPO for the 15 exits last quarter was 9.4 years.

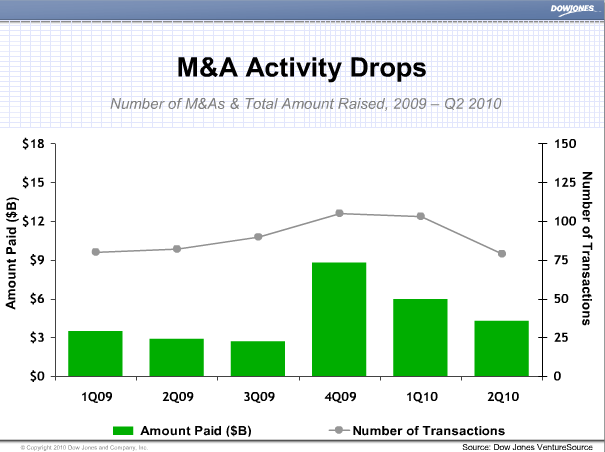

Meanwhile, in M&A land the number of venture-backed deals in the quarter were down slightly to 79 from 82 a year ago. But the amount raised through acquisitions was up 48 percent to $4.3 billion. However, the number of acquisitions and amount raised was lower than in each of the two previous quarters.