Fresh off an announcement of a strategic investment from VC firm Andreessen Horowitz, mobile payments platform Boku is taking its mobile strategy one step further by launching an in-app mobile billing library for Android.

Fresh off an announcement of a strategic investment from VC firm Andreessen Horowitz, mobile payments platform Boku is taking its mobile strategy one step further by launching an in-app mobile billing library for Android.

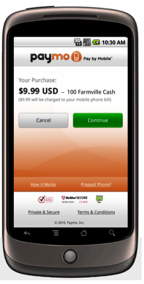

The Boku Payments SDK allows developers to monetize any Android app with in-app purchases via carrier billing. Boku, which just launched last year, doesn’t require users to have a credit card or bank account to make a micropayment. Users enter their cell phone number, reply to a text message and then all virtual charges are automatically charged to the user’s monthly cell phone bill.

Boku’s SDK allows for a one-tap purchase process in more than 60 countries over 200 carriers worldwide without a user login or password needed for purchase. Boku authenticates the transaction and deals with the carrier billing as well. It’s incredibly easy for consumers because they don’t have to deal with the hassle of entering credit card information on their phone.

While the iPhone has supported the idea of In-App purchase for a bit over a year now, Android hasn’t adopted this yet. But as the Android platform becomes more heavily used by consumers, payment companies like Boku stand to profit from in-app purchases. PayPal just launched its Mobile Payments Library for Android, which allows consumers to make transactions without ever leaving the app.

Of course, the potential obstacle to the adoption of Boku are the high fees that mobile carriers charge to the payment systems (which are then passed on to the publisher or developer). Boku told us last June that different cell phone carriers charge varying fees that range between 10% to 50% of the purchase price, which is a hefty amount in transaction fees. But Boku is steadfast in its commitment to remedy this issue. Ron Hirson, Boku’s marketing chief, says the company is ramping up negotiations with carriers to lower these fees.

As I stated above, the barrier for Boku’s system will be the high carrier fees that will be passed on to developers. But if this can be negotiated, the sky’s the limit for mobile payments as an attractive payments platform. Coincidentally, competitor Zong also announced the availability of its payment service for developers this morning. It looks like the two will duke it out for Android developers who want to start monetizing off of their apps. That is, until Google rolls out In-App purchase support for the Android platform