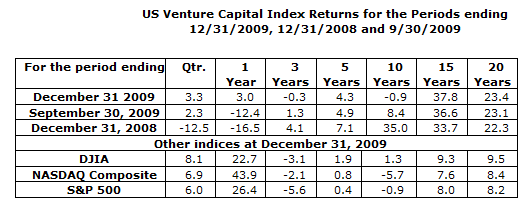

Venture capital returns improved in the fourth quarter of 2009, according to the Cambridge Associates U.S. Venture Capital Index, the performance benchmark of the National Venture Capital Association. Fourth quarter returns saw a 3.3 percent rise, ending the year with a 3 percent return overall, on average.

Venture capital returns improved in the fourth quarter of 2009, according to the Cambridge Associates U.S. Venture Capital Index, the performance benchmark of the National Venture Capital Association. Fourth quarter returns saw a 3.3 percent rise, ending the year with a 3 percent return overall, on average.

The key words here are “short-term improvements,” however, because performance continued to decline in the 5- and 10-year periods ending in the quarter.

Annual returns rose from 2.3 percent in the third quarter of 2009, as venture-backed exits began to show signs of improvement at the end of last and the beginning of this year.

However, 3-, 5-and 10-year returns deteriorated, with the 10 year horizon even falling into negative territory. You have to go back 15 or 20 years to find decent returns of 37.8 percent and 23.4 percent, respectively, and Cambridge Associates is quick to point out that they also continued to outperform public market indices.

The trend, however, is clearly not upbeat news – will it reverse at some point?

The full report is available from the NVCA website.