Two separate reports were released this morning, both bringing upbeat news of increased exit activity (M&A, IPOs) for venture-backed companies in the first quarter of 2010.

Two separate reports were released this morning, both bringing upbeat news of increased exit activity (M&A, IPOs) for venture-backed companies in the first quarter of 2010.

We take a look at the most important findings for both the Exit Poll report by Thomson Reuters and the National Venture Capital Association, and Dow Jones VentureSource’s assessment of IPO and M&A activity in the U.S. during the first three months of this year.

Dow Jones VentureSource

Title: U.S. Venture-Backed Company IPOs in First Quarter Match 2009 Total; M&A Deal Activity Flat as Median Paid Picks Up

Subtitle: M&As and IPOs of VC-Backed Companies Net $4.7B in Q1; Time to Reach M&A Still Low as Investors Sell Companies Earlier

Q1 2010 according to Dow Jones VentureSource:

– Eight U.S. venture-backed companies raised $711 million by going public on U.S. stock exchanges, matching the number of IPOs that occurred throughout 2009.

– It took companies that went public during the first quarter a median of 10.4 years and $156 million in venture capital to achieve liquidity.

– This is more than the median 7.9 years and $32 million in capital it took for companies to reach an IPO in 2009.

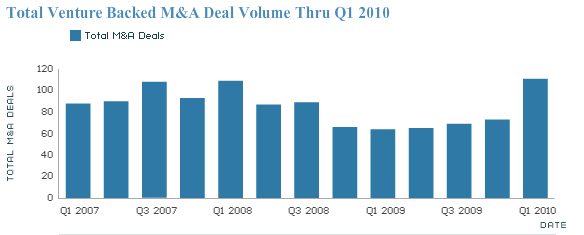

– Corporations bought 77 companies for $4 billion through mergers and acquisitions (M&As), on par with the 77 deals that raised $3.4 billion during the same period last year and a far cry from the 109 deals completed during the first quarter of 2008.

– The $27 million median amount paid for a venture-backed company in the most recent quarter is a 17% increase from the $23 million median paid during the same period in 2009.

– It took a median of 5.4 years for a venture-backed company to reach liquidity via a merger or acquisition, 15% more than the 4.7-year median in the first quarter of 2009, but still less than the medians seen during the same period in 2007 and 2008, 6.1 and 6.6 years respectively.

– Companies that exited during the first quarter raised a median of $19 million in venture capital before exiting through a merger or acquisition, a 19% increase from the $16 million median during the same period last year.

Thomson Reuters / NVCA

Title: Venture-Backed Exit Activity Shows Improved Signs of Life in Q1 2010

Subtitle: All-time Record for Venture-backed M&A Exits; Nearly All Venture-backed IPOs Trading Above Offer Price

Q1 2010 according to Thomson Reuters / NVCA:

– The quarter ended with nine venture-backed IPOs and 111 M&A transactions.

– There were nine venture-backed IPOs valued at $936.2 million in the first quarter of 2010 quarter of 2009, more than double the amount raised during the fourth quarter of 2009.

– Of the nine IPOs in the first quarter, eight were trading at or above their offering prices as of 3/31/2010.

– Three of the eight IPO exits for the quarter were in the Biotechnology sector, accounting for a total of $310.5 million.

– Forty-three venture-backed companies are currently filed for an initial public offering with the SEC.

– 111 venture-backed M&A deals were reported for the first quarter, 31 of which had an aggregate deal value of $5.6 billion.

– The average disclosed deal value was $180.2 million.

– This marks the biggest quarter for overall number of venture-backed M&A exits since records began in 1975.

– The information technology sector led the venture-backed M&A landscape, with 81 deals and a disclosed total dollar value of $2.3 billion.

– Within this sector, computer software and services and internet specific companies accounted for the bulk of the targets, with 35 and 26 transactions, respectively, across these sector subsets.

– Deals bringing in the top returns, those with disclosed values greater than four times the venture investment, accounted for 45 percent of the total in the first quarter of 2010.

– Venture-backed M&A deals returned less than the amount invested accounted for 31 percent of the quarter’s total, on par with total in the previous quarter.

And here’s a bonus report: JEGI’s Q1 2010 M&A Results – Deal Activity and Transaction Value Up (PDF)