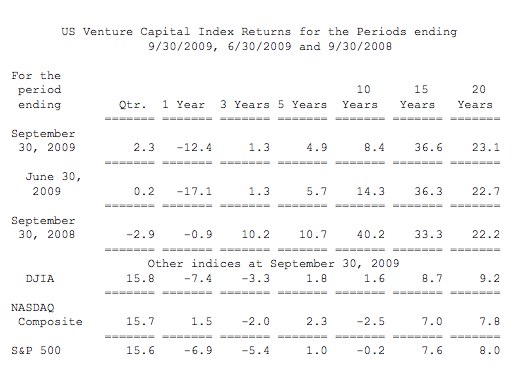

Ten-year returns for Venture Capital firms continue to slide downwards for the 5 and 10-year periods ending on September 30, 2009 according to the Cambridge Associates U.S. Venture Capital Index, the VC performance benchmark of the National Venture Capital Association.

As investments in startups during the lucrative 1990’s tech boom are no longer included, ten-year returns slide to lower and lower levels, dropping by nearly half from the previous quarter.

The 10-year return fell to 8.4 percent from 14.3 percent in the previous quarter and from 40.2 percent one year earlier. The 5-year returns also declined to 4.9 percent from 5.7 percent in the previous quarter and from 10.7 percent one year ago.

While returns are diminishing, investments continue to rise after a year when venture funding was in the doldrums. VC investments in fourth quarter of 2009 rose to nearly $15 billion, up 113 percent from a year ago.

These numbers aren’t surprising, considering the drought in IPOs over the past few years.But venture capitalists and tech entrepreneurs are hopeful that 2010 will be the year they rain down on the Valley once gain, with a handful of promising startups that could be ready to go public this year. In fact, Tesla just filed for a $100 million IPO on Friday.